A belated Happy New Year everyone. One of my new year’s resolutions is to blog more frequently. I love blogging about real estate! I just need to get faster at it. This can be a challenge if you care about getting the facts right. For example, I just spent about 4 hours over 2 days unearthing a discrepancy between my 2010 data on San Francisco home sales and the data provided by my generally excellent real estate feed, which you can find under the Market Trends tab. Turns out they’d incorrectly included sales from the northern part of San Mateo County, which resulted in a much lower median home sales price for 2010 and a very inaccurate read on what had happened in the SF Market over the last year. My next blog will cover those results.

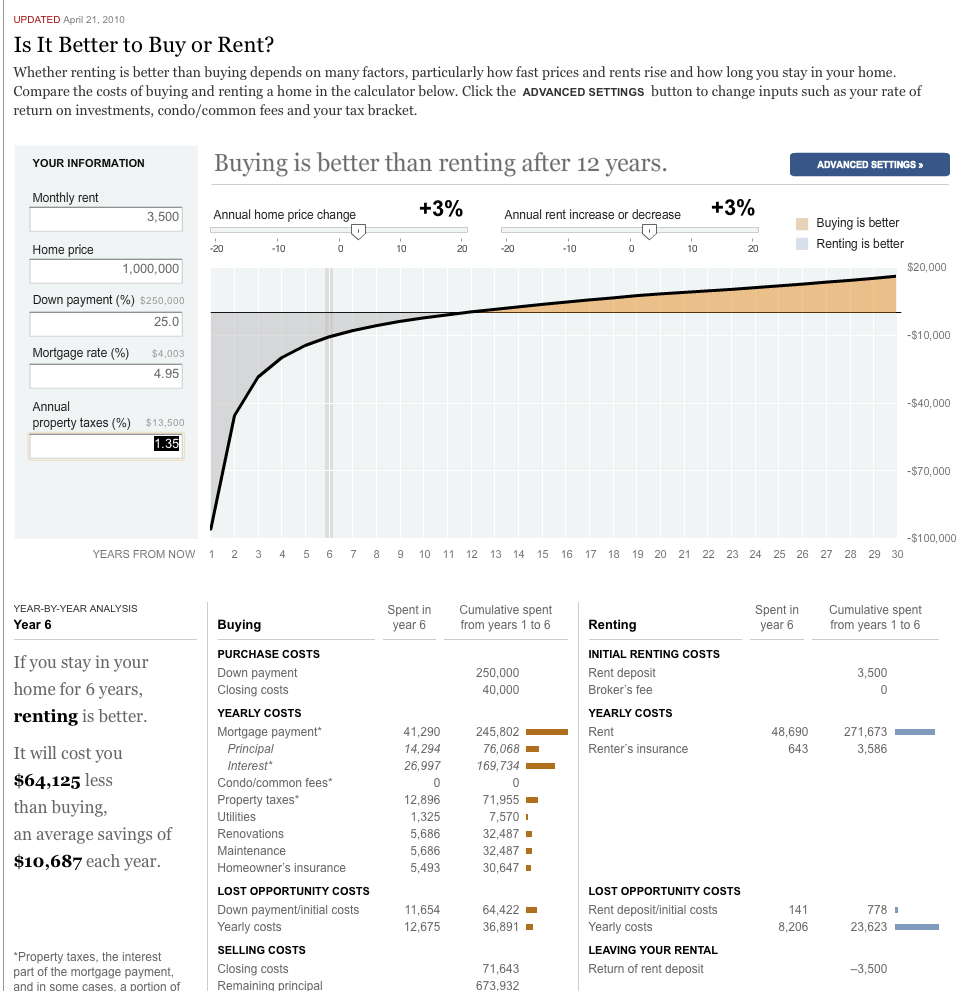

Meanwhile, here is the best “rent vs. buy” calculator that I’ve seen, courtesy of the NY Times. A lot of the calculators out there are either too simple or too complex. This one hits the right balance and wraps it all up with a nice graphic. Here’s a screenshot.

To access the calculator, go here: http://www.nytimes.com/interactive/business/buy-rent-calculator.html. Be sure to click the Advanced Settings Tab if you want to fiddle with details like return on investment and inflation rates.

I picked a few numbers out of my er, nose, to come up with the above screen-shot scenario. If you believe that home values will increase by 3% a year, turns out that if you stay put for 12 years you’re better off buying a home for a million bucks than paying rent of $3500 a month. At least while interest rates are low. Happy calculating!

Related articles

- Rent Or Buy? Freddie Finally Fixes Calculator (npr.org)

- Real Estate Weekly: Rent prices rose 12% last year, report says (marketwatch.com)

- Where Is It Cheaper to Rent? New York City (Really) (time.com)

The simple calculator is good, but it doesn’t take into account one of the most basic and important qualities about home ownership – the tax benefits of owning. The calculator should include your yearly income and tax bracket and factor that basic piece of the puzzle. For many people, the fact of the matter is that that money you “save” by renting and not buying is actually going to be paid in income taxes, when that same money could be paid into a mortgage where the interest is a huge deduction.

Actually, I believe it does. Indeed, it would be a pretty bad calculator if it didn’t since as you point out the interest and property tax deductions are a significant part of the equation. The simple model appears to use a default marginal tax rate of 20%. However, that can be changed by going to the Advanced settings, and then to the “Other” Tab, listed under the “Buying” and “Selling” Tabs on the left of the page.