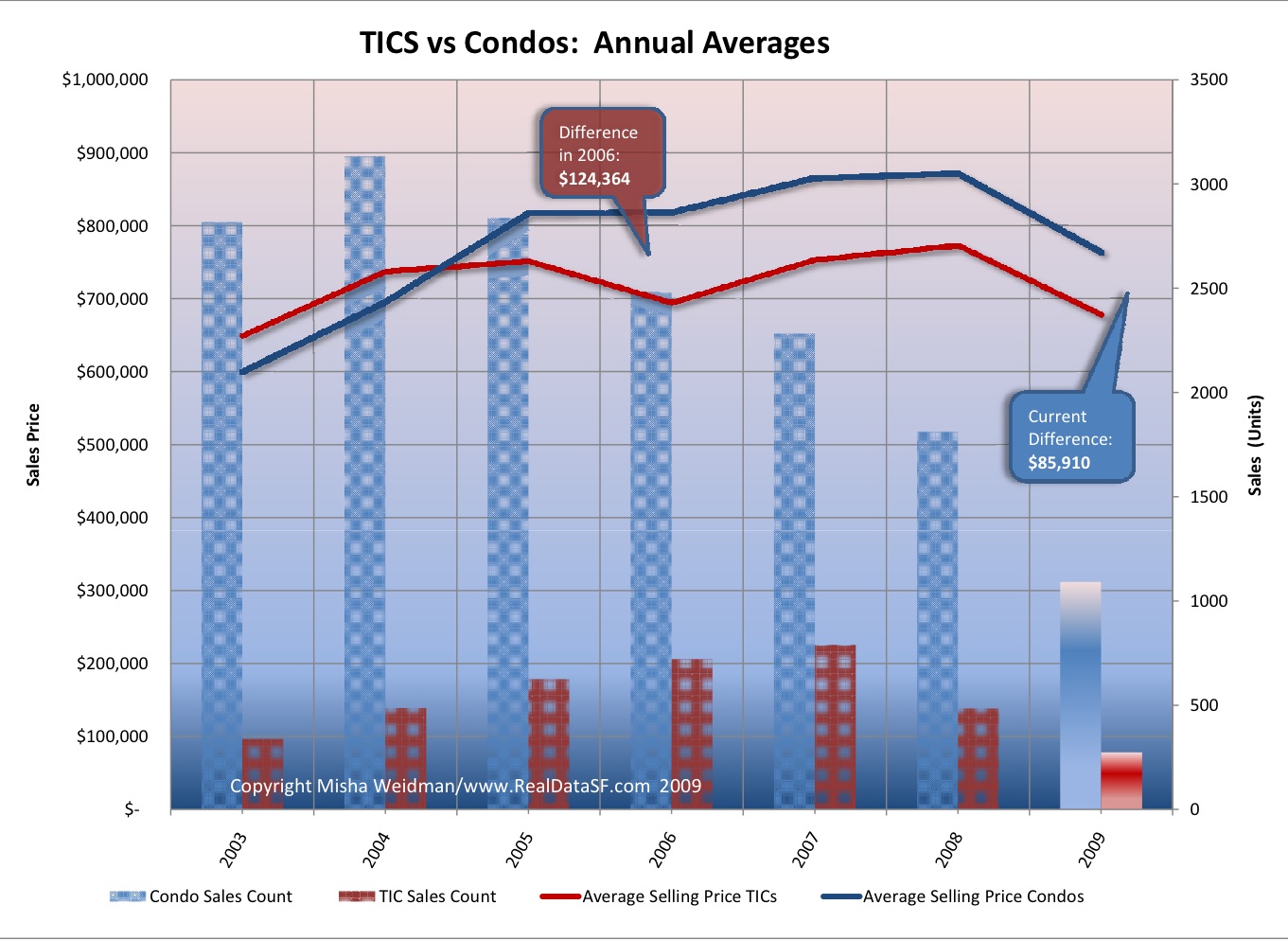

Last post, we determined that the current difference between the average (annual) price of a condo and that of a TIC is $86,000, down from a high of $124,364 in 2006. (That’s a 30%+ drop, by the way.) Here’s the chart again (sorry for the funky transparency on the sales volume bars).

That’s useful if you’re looking at an average-priced TIC and you’re curious about how much of a premium you’d have to pay for an average-priced condo. But how about reducing that to a per square foot premium?

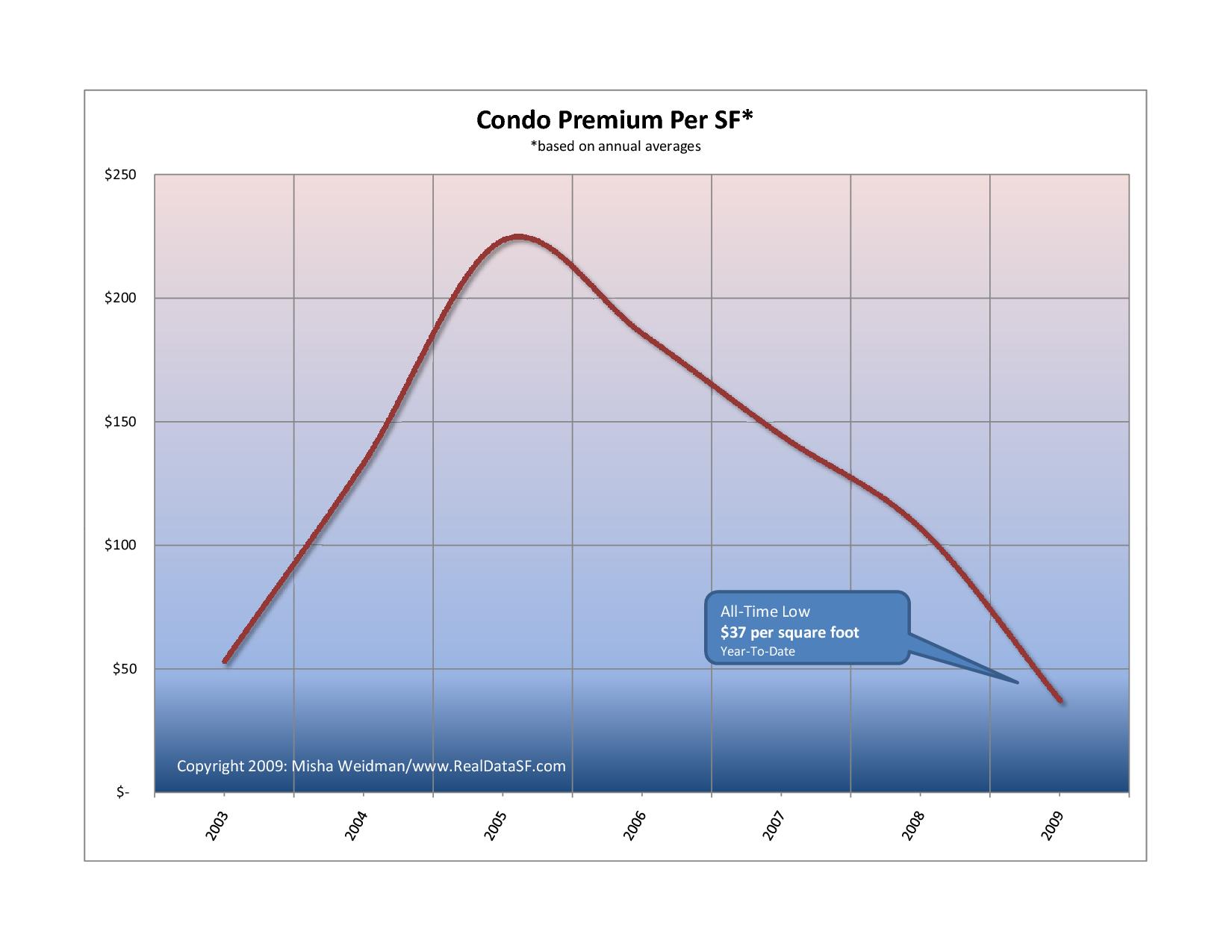

For those who just want the bottom line, here’s the answer, but it’s worth reading on for the caveats.

$37 a foot doesn’t sound like much of a condo premium to me, that’s for sure. And as my astute readers will note, the drop in price on a per square foot (from around $225 per sf) is obviously much more than the drop in median sales prices shown in the previous chart.

What’s going on? It’s really simple: there’s a lot less information on sales price per square foot for TICs.

All my data comes from the MLS (Multiple Listing Service) that real estate brokers use to find and market properties. When a sale’s completed, they are required to enter the sales price. If there’s information on the square footage of the property — provided by the owner or more frequently from the property records — the database calculates a per square foot price. Roughly 80% of condo sales have a recorded price per square foot in the MLS. Only 45% of TIC sales have a recorded price per square foot. How bad is that? In September 09, there were just 27 TIC sales. Only 9 of them had a recorded price per square foot. For all of 2009 through September, there were 275 TIC sales. Only 113 – 41% – show a per square foot price.

There are lots of people — mostly on other blogs 🙂 — who love to trash statistics and say they’re meaningless. Medians don’t reflect home values, etc etc. I disagree. Provided you have enough data and you understand what you’re measuring, statistics help make sense out of what is otherwise undifferentiated data. But I am afraid that in the case of measuring the condo premium on a per square foot basis, we are in dangerous low on data.

One final reminder: For this series of posts, my TIC data includes the handful of stock cooperative sales that occur in this market.

And thanks for sticking with me on this long series of posts….

113 TIC units with sq ft data is EXTREMELY statistically relevant. The question you have to ask is, why is the percentage of TICs reporting sq footage lower than for condos. Is there a bias that TIC owners inject into the system (i.e., they don’t want people to see what the sq ft # is?). I don’t see how that can be, since condo owners and TIC owners face the same set of influences when it comes to posting sq ft data. Rather I would propose the following: when you subdivide a property into condos, each unit has a very precise sq ft # applied to it, courtesy of the surveyor. TICs that are 4 units or less (the majority) are NOT required by law to have a [expensive] survey done. Given that incorrect reporting of sq footage is one of the highest sources of post-purchase lawsuits, it is reasonable to think that many of the owners selling a unit in a 1-4 unit TIC would not report the data, because they are effectively guessing.

I completely agree with you about the point on square footage. 113 data points may be sufficient for SOME statistical conclusions, but I do think that one has to be very cautious in drawing conclusions when you’re comparing to four times as many condo sales, 80% of which have accurate — hopefully — square footage data. Thanks for your comments!

well there’s a lot in the 3 part report i can’t agree with, although i do appreciate the effort that went into the analysis.

firstly – saying that TIC’s are riskier than Condos seems like a knee jerk reaction among Realtors. What about the NUMEROUS exceptions to that supposed rule. take for example all new condo buildings that sold between 2004 and 2008… ie, the Palms at 555 4th, 140 S. Van Ness, the Beacon, etc. Many bought with 0% to 10% down. Now they are getting hit with massive amounts of Short Sales and REO’s…. AND unpaid HOA dues.

Meanwhile with TIC’s 20% to 25% down has always been pretty standard. I don’t know where to find stats, but I’d guess defaults on TIC units are well below defaults on Condos. So which is riskier????? Could SOMA turn into Miami with empty buildings and no one paying HOA dues? I hear even the Brannan has a lot of late HOA payers and they were built in 2000. Fat chance of something like that happening in a TIC building with much more equity.

TIC’s with shared group loans tend to have even higher equity. So if an owner can’t pay the bills, chances are the other owners would be happy to take over the defaulter’s unit just to get at the equity. But of course the defaulter will have a far easier time selling since they have equity to play with to get it done.

i’m also seeing a growing theme where agents i read on places like Trulia that TIC lenders could go away. Give me a break. When they can charge 1 to 2 points more in interest, with 20% to 25% down as standard on a unit that is priced 20% below a comparable condo, where defaults are almost certainly far less than condos – which would you rather loan on???? When there’s money to be made, there will be capital available.

lastly, I’m a condo owner. I’m involved in my HOA board and find shared ownership to be a hassle. Why do people think only TIC’s have “shared ownership” problems???? Also, banks are now refusing to let owners in my building re-finance unless or until we meet newly created criteria. So much for owning our own units – it’s obvious the bank owns them. Overall the other idea that many agents spout about TIC’s being “shared ownership” in a way that Condos are not is also largely bunk IMHO.

Yes, there are advantages to owning a Condo. Unfortunately it seems to biggest one is that you don’t have to deal with the bad rap and mis-information that TIC’s have – deserved or not – so Condos are and will be easier to sell unless or until Agents and the public become better educated.

Given my long comment I’ll just briefly touch on your stats – which I again thank you for. The more recent data chart is extra flawed because there are even fewer TIC sales happening now…. and there seems to me to be an obvious trend towards super-remodeled TIC units. So the few that are selling are luxury which has caused the premium to contract in your chart – but not in reality. In my opinion TIC’s are much cheaper today than 2 years ago vs. condos – again, many are not selling at all – if they did it would be at extremely low prices. And those that are selling are pimped out and therefore “premium” priced.

Thanks again for all of the charts and stats. I did find them very useful.