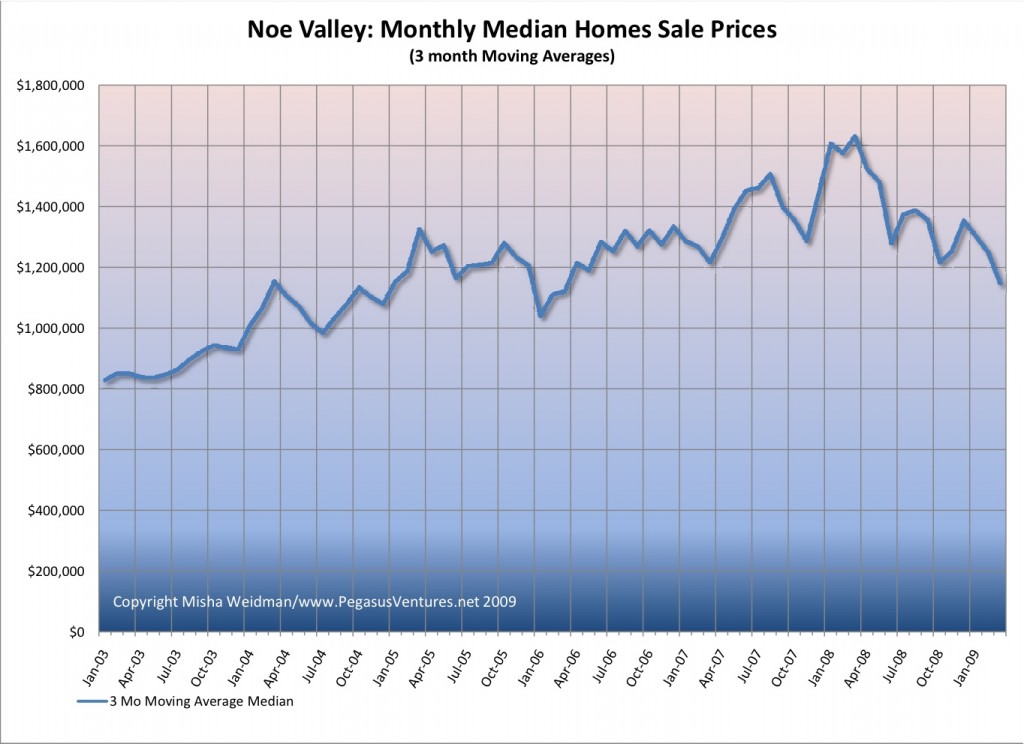

I’ve been having an interesting discussion with a regular reader of theFrontsteps, where I first posted my chart on Noe Valley Percentage Change from All-Time High. He disputes the fact that Noe Valley has fallen by 30% from its all-time high (reached in March of 2008) because he claims — I think — that March was aberrational. I’ve looked again at the data for that month and I disagree. What’s more I think that if you look simply at median prices (moving averages), they show a pretty extended upward trend from the beginning of 2006 through March 2008, with the exception of a dip during the Fall of 2007. Here’s the chart (click to enlarge). Enough said. I’m moving on to another subdistrict.

-

-

Recent Posts

- With Facebook Not Looking So Good, Is the Bloom Off the Rose in San Francisco’s Residential Home Market

- Social Media Boom Fuels San Francisco’s Rental and Home Sales Market

- San Francisco Housing and Rental Markets: Choose a Rock or a Hard Place

- Listed to Luxe in Under 30 Days

- Giving Credit Where It’s Due

-

interest rates Mortgages luxury homes Nouriel Roubini median price TICs Rants Bernanke DOM 2009 Charts Market single family homes New York Times Data home premium San Francisco Noe Valley Marketing 729 elizabeth street Forecasts Economy Credit crunch Market news Sonders ken rosen Tenancy In Common SF real estate single family case-shiller Condominiums trends fisher school District 5 Pacific Heights 2010 Buyers condos condominium UC Berkeley tax credit Front steps Blogging rent vs buy construction

Categories