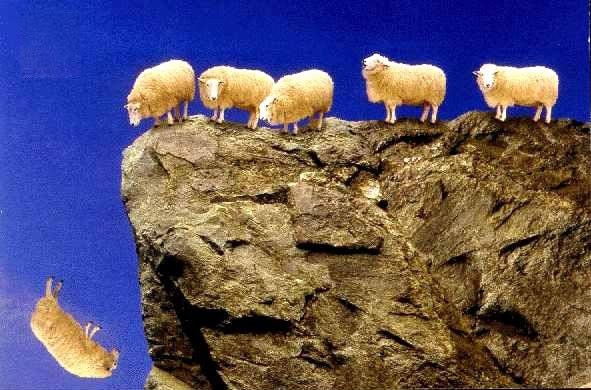

I really couldn’t find a suitable graphic for a falling shoe….

Thanks to my reader JC for pointing out the San Francisco Chronicle’s September 21 article on the $30 billion or so in “option ARMS” that are going to reset, starting in 2010. These are not the subprime ARMS that caused the derivative markets to unravel, the ones that closet reactionaries are still all too eager to blame on the avaricious poor (now is that an oxymoron?) who signed up for them.

No, these are the the loans that the relatively well-heeled and savvy took out to buy their higher end homes. They appreciated the “options” an option ARM offered. Like being able to pay just the interest for the stated fixed period of the loan — often 5 years — rather than paying down the principal as well. Or even paying less than the interest due and rolling the balance into the principal, just like those negative amortization loans that got us into so much trouble in the 1980s. (We really never learn, do we.)

According to the article, fully 1 in 5 of every home loan made in the San Francisco Metropolitan Statistical Area from 2004 to 2008 was an option ARM. Since most of these were 5 year option ARMS, the leading edge of these loans is about to hit market. Here’s why it matters:

After five years, or once the loan balance reaches a certain threshold above the original balance, the mortgages “recast” and borrowers must make full principal and interest payments spread over the loan’s remaining life…. [N]ew payments average 63 percent higher than the minimum payments, but could be more than double in some cases.

Pingback: Fears of a New Chill In Home Sales | Real Data SF