On the anniversary of Lehman Brothers’ demise and the near-collapse of global markets, it seems appropriate to take a step back from our little corner of heaven for a wider view.

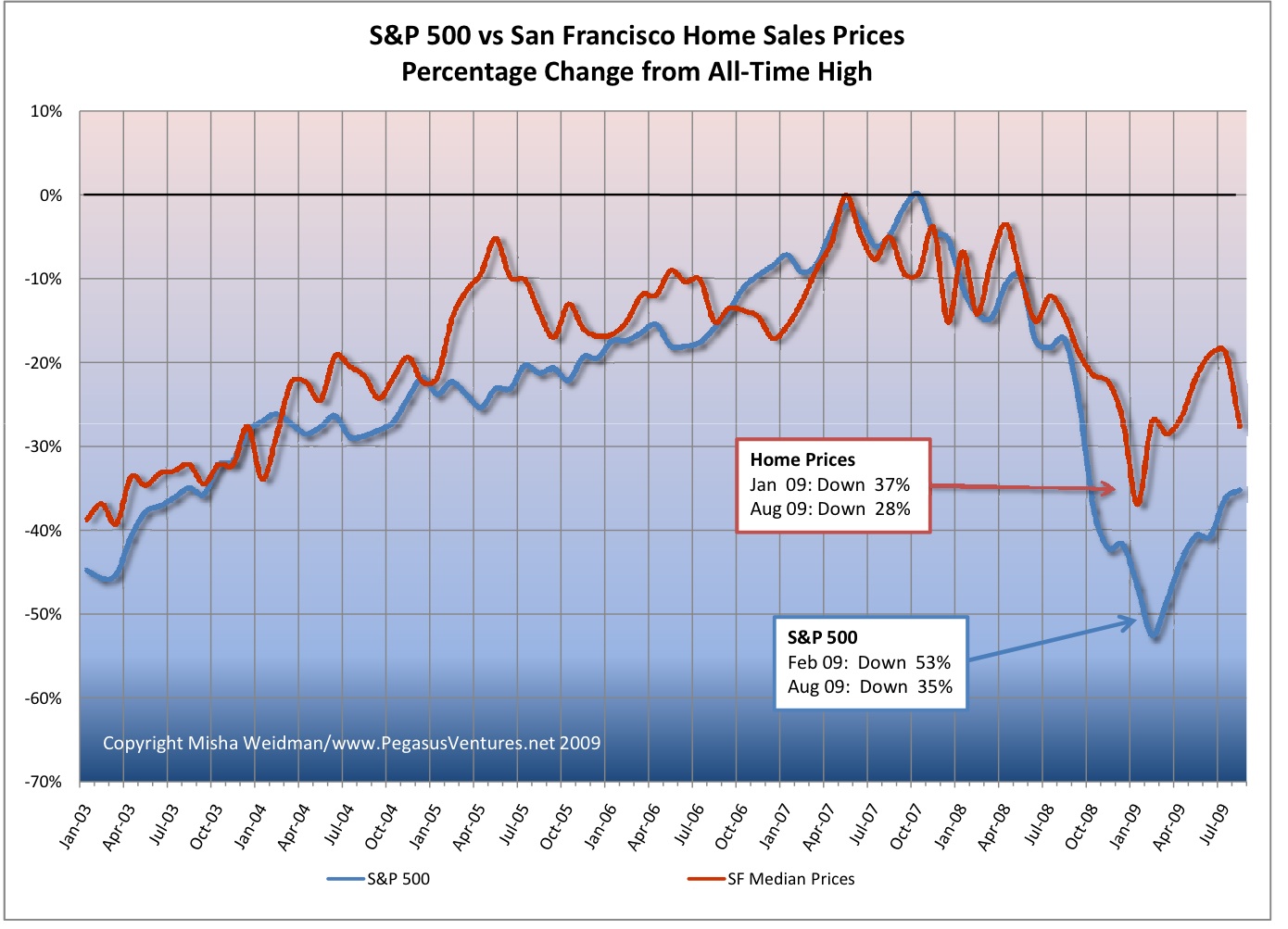

Given where we were a year ago, the world seems to have heaved a huge, if cautious, sigh of relief. During the chill days of February, the stock market had lost more than half it’s value. Now it’s down “only” 35%.

San Francisco home prices have also improved. In January home prices were down 37% from their all-time highs. By July prices had recovered 11%. In August, however, prices fell back 2%. That’s a pretty stiff drop. (Click the chart for a big version.)

A sign of things to come? Who knows. Everyone seems to have a different letter of the alphabet – or at least the nether end of it — to describe the shape the recovery will take.

Ben Bernanke’s is a long, flat “U”: he thinks we’re on the way, but it’s going to be slow going.

Liz Ann Sonders, Schwab’s chief forecaster and one credited with having seen the train-wreck coming, holds out the possibility of a “V”, in which the economy bounces back like a “coiled spring,” propelled by low inventories and a recovering housing market. You can dismiss that view as self-serving, but I prefer to give her the benefit of the doubt, especially since she’s been right before. Though I’m not sure she’s right this time.

The one that worries me the most, though, is the “W” , otherwise known as the dead-cat bounce or “double-dip” to cat-lovers. Nouriel Roubini, no slouch at forecasting himself, has recently said that there’s a “small probability but rising” that we’ll not only run out of steam but fall back again, victim to enormous deficits and the premature closing of global cash spigots, among a host of other ailments. To that rosy picture, he adds the specter of stagflation, as unsustainable budget deficits lead ultimately to higher interest rates while the economy remains weak. Perhaps that’s the “X” scenario.

As for San Francisco, the housing market certainly seems sunnier these days, with volume at decent levels. But I wouldn’t be surprised to see it turning colder, along with the weather.

Good piece. You’ve covered the many different forms of recovery. Liz Ann’s a sharp, articulate chief investment strategist for her company. She makes a good case, pointing to manufacturing and housing.

But consumers remain gun shy and have turned away from their spendthrift ways, becoming born again savers. We’ll have to see whether or not they’ll backslide and power a more robust recovery.

Short and sweet, Misha. More bankruptcies are coming more jobs will be lost. The cash rich companies will make it and invest the other ones will go and unemployment will rise. Right now everybody’s strategy is wait, cross your fingers and pray (which can be uncomfortable to do simultaneously.) The reality is credit cards are not getting paid, less and less indeed. I think the next holiday season – read Xmas will tell us how everybody really feels. W recovery sounds good to me (well bad). But I prefer the UU shape personally. As for predictions, the economists are best at telling you why they were not wrong even if it did not play out as they predicted… it is the dismal science after all.

Pingback: A Faltering Housing Market? | Real Data SF

Pingback: Alphabet Soup Revisited: What Shape Will the Recovery Take? | Real Data SF