I’ve been digging a bit deeper into the raw data that’s used to generate the beautiful graphs you can find here and which I used to generate the MLS District graphs in my blog of a few days ago.

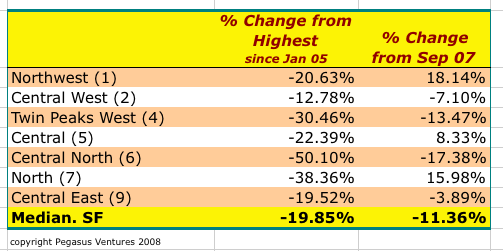

So I thought I’d check how September 08’s median home prices (condos will come later) compared to their all-time highs and to the median prices of a year ago, both by MLS District and for all of San Francisco. I didn’t include District 8 (North-east) because it doesn’t have enough data to be useful, and I also didn’t include the southern-most districts of SF (3 and 10) because to be honest I don’t follow them closely. Here’s the result:

So clearly prices are down from their all-time highs across the board. (Most districts were still hitting highs or near-highs well into 2007, by the way, and District 5, which includes Noe Valley had its top 3 highs in 2008!) ) But where the drops are really big (Districts 6 and 7 for example), that could simply be due to the fact that the all-time high was aberrational.

The percentage change from a year ago are interesting because you can see how some districts seem to be doing quite well. Half up, half down. Once again, though, with sales volumes down across the board, there are less data points and that can skew the numbers. But it certainly seems like the tonier districts (1, 5 and 7) are holding up better than the others. (Take a look at my graph from a coupla days ago to see how the districts compare over time.)

Bottom line(s)?

San Francisco single family homes are down over 11% from a year ago.

The more expensive neighborhoods seem to be doing ok.

Your writing about the challenges of qualifying for and obtaining low rate jumbo loans is proven by my experience as an investor.

I’ve been poking at several properties in the $1.5-$2M range. My loan brokers tell me I’ll need 25%-30% down, 750 credit, full documentation, etc. I’ve got 20% – not 30, and being self employed, my tax returns are designed to my maximum benefit, but will Not impress any lending institution.

So, I’m out of the buying game until these jumbo loans come within reach.

Ok so where do we go from here?

Shawn: thanks for commenting. As to where we go from here probably somewhat down or sideways for a while. I think that there’s so much turbulence that it’s hard for economists to predict, let alone your local blogger. That said, the credit markets are beginning to loosen up; refinancings are really picking up speed. If that continues, maybe a basically sound — if expensive — market like San Francisco will firm up reasonably quickly.